PART I: BEYONCÉ’S STREAMING STRATEGY

WHAT HAPPENED?

NETFLIX IS A GREAT WAY TO REACH CASUAL FAN

– Let’s assume Netflix paid $30 million to produce and market Homecoming.

– According to the Financial Times, Netflix’s customer lifetime value is just under $200. A 3:1 ratio of “lifetime value” to “customer acquisition cost” is a common target in tech.

– If Netflix wants Homecoming to meet that, the documentary needs to bring in (or maintain) 450,000 subscribers to justify the $30 million it spent.

– That’s a relatively small number for a service that has 140 million subscribers and grew 9 million in the first quarter of 2019.

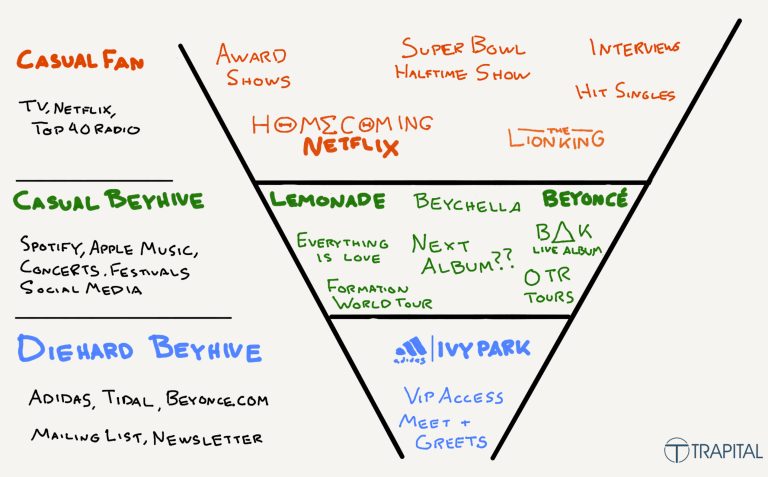

If the documentary resonates with this casual audience, they will move further through Beyoncé’s sales funnel. They will be more willing to attend her next concert, buy Ivy Park merchandise, and subscribe to Tidal. Beyoncé would have lost out on the opportunity to convert casual fans if Homecoming was exclusively on Tidal—which serves an audience that’s already bought in.

Update: Homecoming drew in 1.1 million viewers on its first day. That puts the documentary in a special group of Netflix mega-hits like Bird Box, Bright, Tiger King, and The Irishman (but on a much cheaper budget).

Homecoming also set a record for black audience viewership. On its premiere day, 63% of its viewers were black. It helped boost Netflix’s Strong Black Lead initiative that was relatively new at the time.

What does it means?

1. Given the strong influence this audience has on culture (which drives viewership), it’s a more valuable customer than the average Netflix subscriber. A standard customer acquisition cost / lifetime value ratio would undersell Homecoming. Not all customers are equally valuable.

2. It also reinforces the Coachella documentary’s position as a top-of-funnel draw for the 38-year-old singer. It would have been much harder to reach 1.1 million day-one viewers on any other streaming service.

BEYONCÉ CARES MORE ABOUT SPOTIFY THAN YOU THINK

Spotify currently has over 200 million on its free and paid tiers combined. Everything Is Love and Homecoming: The Live Album are on Spotify for the same reason Homecoming is on Netflix. Lemonade was made available on Spotify and all other streaming platforms. It’s a gateway to the casual audience.

Streaming exclusives have largely faded away. Most major artists stopped releasing exclusives. But the short-lived strategy was still critical for initial audience growth on the digital streaming providers. Tidal’s exclusives helped acquire its ideal customer. The company has doubled-down on that customer profile with its hip-hop-focused content strategy. The same is true with Apple Music.

TIDAL WILL STILL BE HOME FOR THE DIEHARD FANS

Tidal’s business model has served Beyoncé well for these reasons:

1. She gets paid nearly double what Spotify and other services pay artists per stream. The Beyhive has streamed Lemonade more times than it can count. Those streams add up (unlike a documentary, which is revisited far less often).

2. Since Beyoncé is a part-owner in Tidal, her team should have access to its valuable data on subscriber listening habits.

Tidal may not have started as a segmentation tool for Beyoncé, but it ultimately became one. At the moment, current subscribers might be annoyed that Homecoming and its live album weren’t exclusive theirs. But they shouldn’t worry. The album they really want should be on its way.

HIP-HOP’S VEBLEN GOOD

The Beyhive membership is a true Veblen good: the demand for her products increases as the price (and scarcity) increases. However, Beyoncé’s brand, unlike other Veblen goods, doesn’t relish in its high-priced exclusivity. She wants to leave a legacy and be an inspiration, especially for those less fortunate. It’s harder to do that if her core audience is rich people. Luckily, her newsletter and social media following provide connections to those proud Beyhive supporters who would support more if they could do so.

PART II: LOOKING BACK ON SKY TOUR MOVIE

HOW DID M-TP ENTERTAINMENT LEVERAGE SKY TOUR MOVIE?

Sơn Tùng M-TP’s documentary film Sky Tour Movie was released in cinemas nationwide on June 12, with a movie trailer on Youtube. After that, Sky Tour (Original Motion Picture Soundtrack) was released on Spotify and Apple Music.

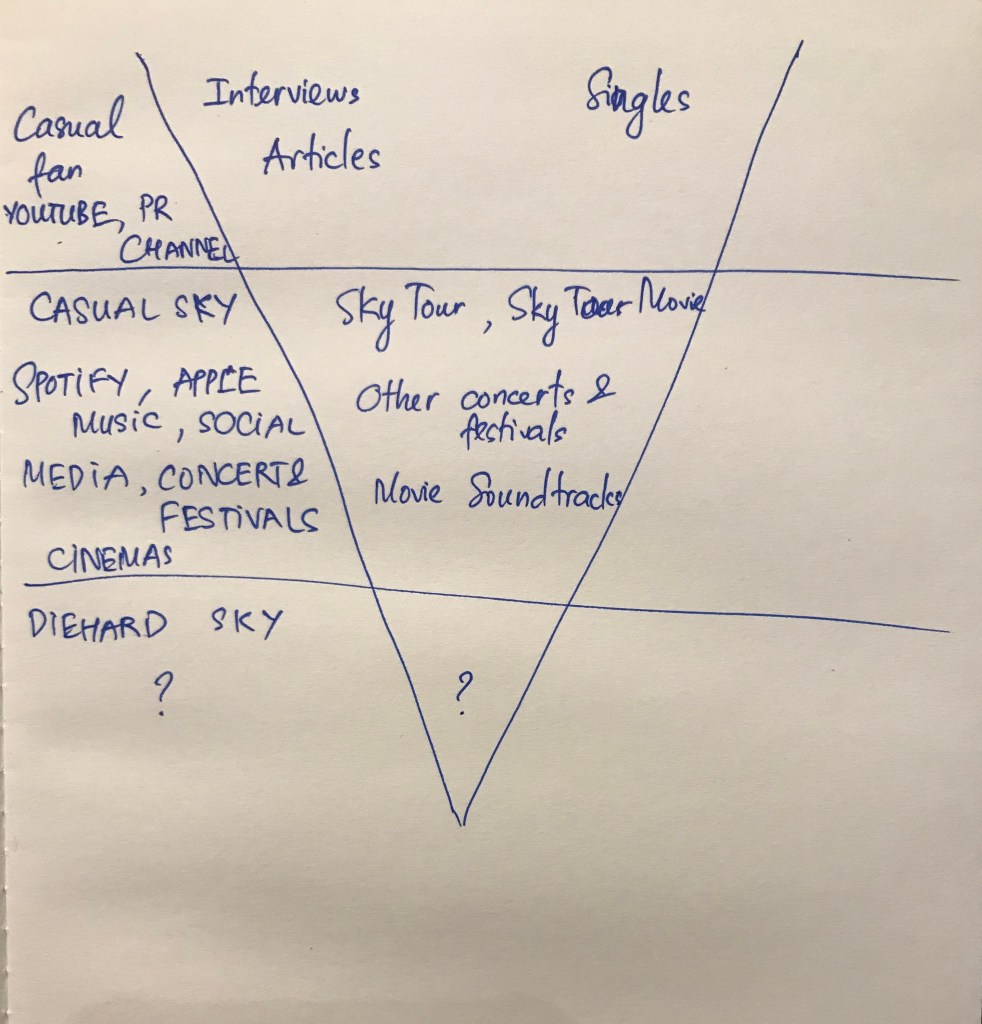

Let’s take a look at Sơn Tùng M-TP’s sales funnel I drew:

The whole documentary film and other related content tend to have impact on Casual Sky group only. But in Beyoncé’s case, this picture will clearly show her (and her agency’s) purpose:

(Casual fan) Watch the film (on Netflix) => (Casual Beyhive) Listen to the album (on Spotify) => (Diehard Beyhive) Shop the collection (on Beyonce.com). And she maximized the impact of Homecoming documentary, reaching mass audience, converting them to the next level in her sales funnel and serving the loyal fan base also.

From my point of view, documentary film is a way to build emotional connection between artist and audience, it is useful in bringing audience to the next tier of fan. In the case of Sơn Tùng M-TP, if he distributes the movie on other digital platforms (such as FPT Play or Netflix) once the sensation from cinema is over, he may maximize reach with mass audience while loyal fans are still given early access.

WILL HE DO ANYTHING TO FILL THE BOTTOM OF THE FUNNEL?

So far, Sơn Tùng M-TP hasn’t provided his diehard fans with any exclusive content. If I were a member of his team, I would place “building fan culture” high on the agenda, since fandom is one of the biggest growth driver in the current music market. K-pop artists and Japanese idols have waken up Western labels to that opportunity.

Next time, I will make a whole post about building and monetizing fandom.

Source: Beyoncé’s Streaming Strategy, Explained and Beyoncé’s Streaming Strategy, Revisited